« Yukon Gold Casino Review ? Video Games, Safety Check, Expert Ratin | Main | Vulkan Vegas Promo Code Dezember 2023: 125 Freispiele Und Bis über 1000 Bonu »

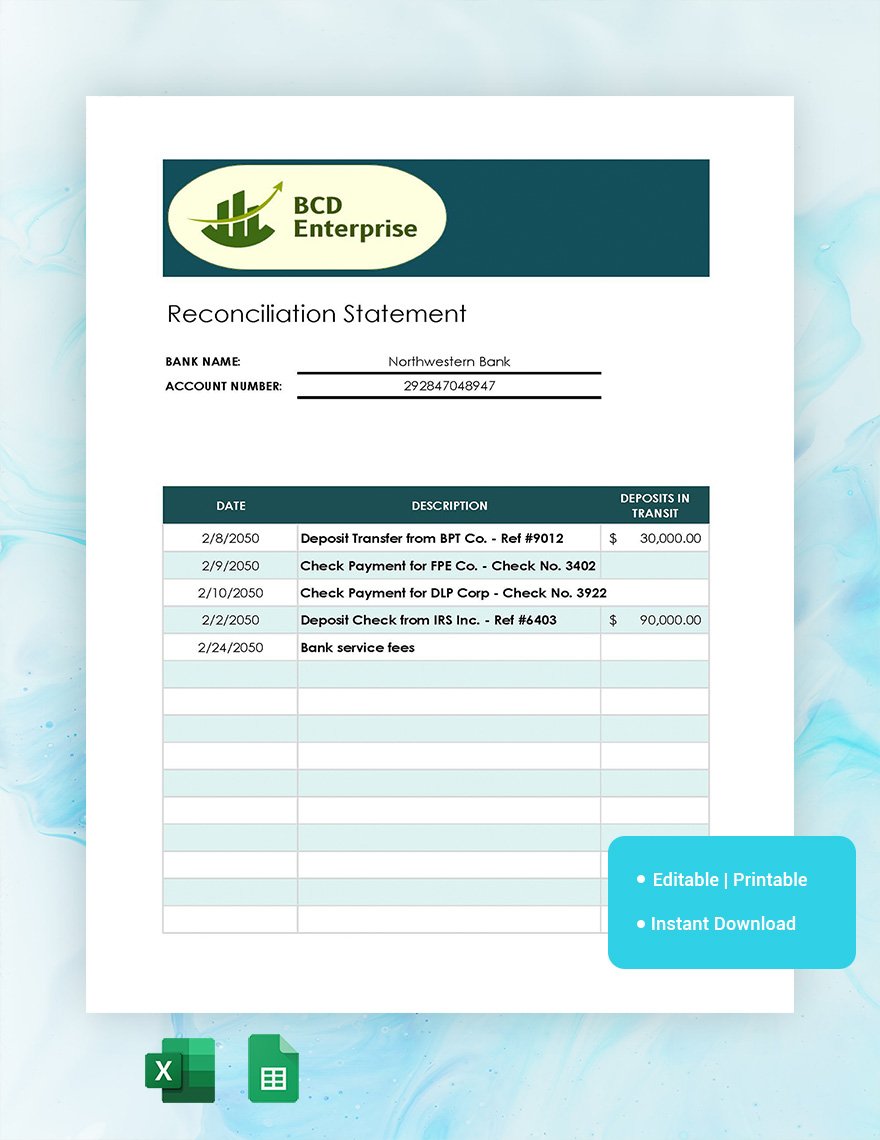

Cost Reconciliation Process: Cost Reconciliation Best Practices for Small Businesses

By admin | November 29, 2022

Companies with single-entry bookkeeping systems can perform a form of reconciliation by comparing invoices, receipts, and other documentation against the entries in their books. Businesses are generally advised to reconcile their accounts at least monthly, but they can do so as often as they wish. Businesses that follow a risk-based approach to reconciliation will reconcile certain accounts more frequently than others, based on their greater likelihood of error. Reconciliation is an accounting procedure that compares two sets of records to check that the figures are correct and in agreement and confirms that accounts in a general ledger are consistent and complete. In double-entry accounting, each transaction is posted as both a debit and a credit. A Total costs to beaccounted for (step 2) must equal total costs accounted for (step4).

ARN Number: What Is It And How To Track Transactions?

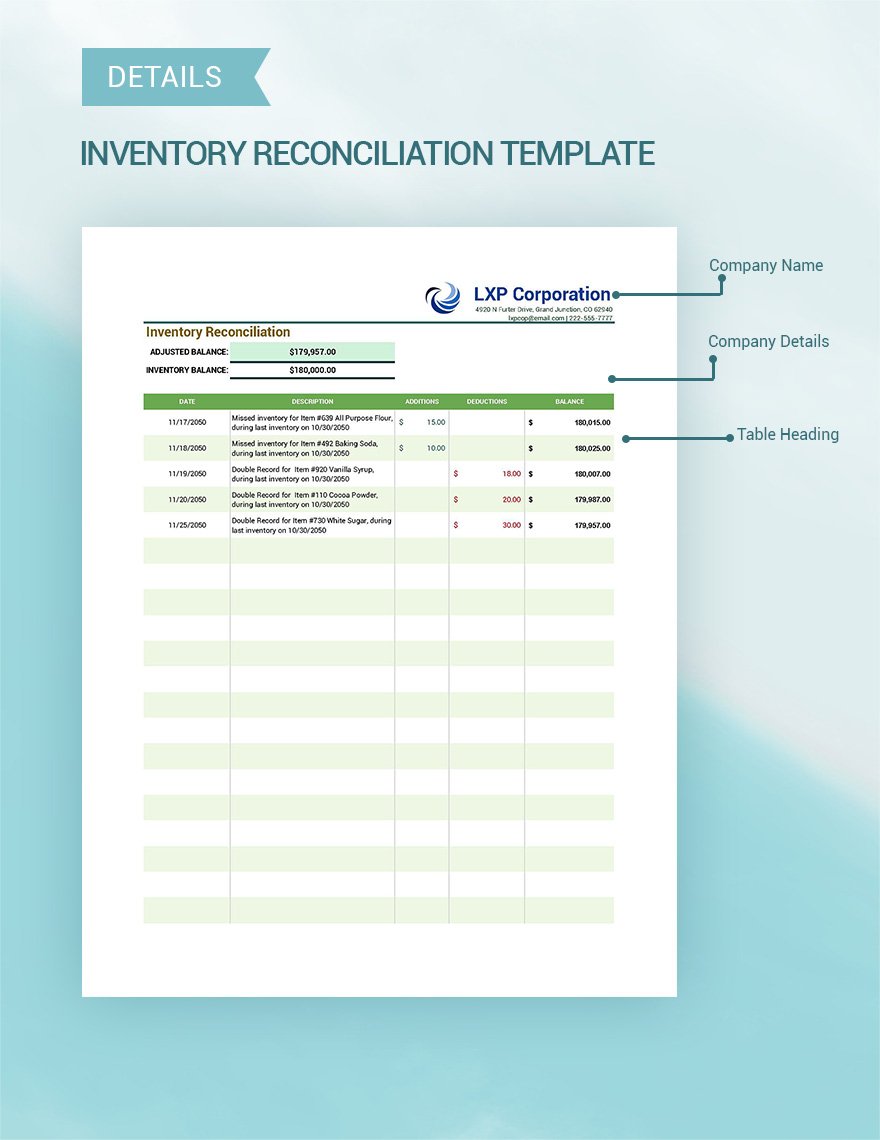

The conflicting information provided by these two sets of accounts may not help organizations make correct policy decisions. Thus, the system of costing should be capable of reconciliation with financial accounts. All the calculations are to identify any discrepancies that exist between these two sources. Totals agree with one another by accounting for all differences that could be causing the discrepancy in costs.

- Discrepancies are the differences or inconsistencies between the actual cost and the expected or budgeted cost of a project or process.

- Asset retirement is the process of removing an asset from service and accounting for its costs.

- Accurate and timely cost estimations and expense tracking are required to complete the CVR analysis.

- For example, if the actual cost of materials for a project was $10,000 and the budgeted cost was $8,000, the cost variance would be $2,000 or 25%.

- Communication is key when it comes to reconciling the financial accounts of any business.

- Banks and retailers can make errors when counting money and issuing cash to customers as change.

6: Preparing a Production Cost Report

We define Free Cash Flow as Cash provided by operating activities less capital expenditures, which is disclosed as Purchases of property, plant and equipment in the Company’s Consolidated Statements of Cash Flows. We use Free Cash Flow, among other measures, to evaluate the Company’s liquidity and its ability to generate cash flow. We believe that Free Cash Flow is meaningful to investors because it provides them with a view of the Company’s liquidity after deducting capital expenditures, which are considered to be a necessary component of ongoing operations. In addition, we believe that Free Cash Flow helps improve investors’ ability to compare our liquidity with that of other companies. Consolidated direct operating expenses increased $29.7 million, or 7.8%, during the three months ended September 30, 2024 compared to the same period of 2023. The increase was primarily driven by higher variable content costs, including higher third-party digital costs and podcast profit sharing expenses related to the increase in digital revenues.

Who Is Responsible for CVR?

This means that the cost items and categories used in the cost reconciliation process should be well-defined and aligned with the project scope, objectives, and deliverables. For example, the cost of labor, materials, equipment, overhead, and contingency should be clearly distinguished and classified according to the project phases, activities, and tasks. This can help avoid confusion, ambiguity, and duplication of cost data among the parties involved in the cost reconciliation process. It can also help ensure that the cost data is relevant, reliable, and comparable across different sources and reports.

Reconciliation of Cost Accounts and Financial Accounts

This meticulous approach serves not only as a measure of financial health but also as a strategic tool for forecasting and decision-making. By maintaining a clear ledger of expenses, organizations can identify areas of inefficiency, uncover potential savings, and allocate resources more effectively. At the heart of financial clarity within organizations lies the meticulous process of aligning reported costs with actual expenditures—a practice essential for accurate budgeting, forecasting, and strategic planning.

Do you already work with a financial advisor?

Access Coins, our powerful construction management software, includes a module devoted to calculating and reporting CVR which cuts days of work from the CVR reporting process. The good news is there are solutions out there to simplify the CVR reporting process – learn more about our construction financial software, with features built to help automate CVR calculation and reporting. To reduce this risk, construction companies are use software such as ERP (enterprise resource planning) to automatically collect and calculate financial data across a range of sources.

Vaia is a globally recognized educational technology company, offering a holistic learning platform designed for students of all ages and educational levels. Our platform provides learning support for a wide range of subjects, including STEM, Social Sciences, and Languages and also helps students to successfully master various tests and exams worldwide, such as GCSE, A Level, SAT, ACT, Abitur, and more. We offer an extensive library of learning materials, including interactive flashcards, comprehensive textbook solutions, and detailed explanations. The cutting-edge technology and tools we provide help students create their own learning materials. StudySmarter’s content is not only expert-verified but also regularly updated to ensure accuracy and relevance. By employing these techniques, businesses can ensure their financial data accurately reflects their economic activities, thereby aiding strategic decision-making.

Mark P. Holtzman, PhD, CPA, is Chair of the Department of Accounting and Taxation at Seton Hall University. He has taught accounting at the college level for 17 years and runs the Accountinator website at , which gives practical accounting advice to entrepreneurs. The content in this article is for general information and education purposes only and should not be construed as legal or tax advice.

Bricks makes it easy to create docs, reports, presentations, charts, and visuals backed by your data. In short, while it might require some effort, regular reconciliation is well worth it for the peace of mind and accuracy it provides. Understanding the nature of these differences is crucial to resolving them. This can help you total amounts that meet certain criteria, such as all transactions on a particular date. Begin by entering the data from your bank statement into the “Bank Statement” sheet.

Ascertain the extent of the difference between indirect expenses as recorded in financial accounts and the charges made in cost accounts. Thus, the aims, objects, principles, and methods of maintaining cost accounts and financial accounts differ, meaning the profits shown how to calculate the right of use asset amortization and lease expense under asc 842 by the accounts may not align. Businesses maintain cost accounts and financial accounts based on a non-integral system or integral system of accounting. Reconciliation processes present a challenge to businesses as they seek to make sure both financial accounts are.

Topics: Bookkeeping | Comments Off

Comments are closed.