« Trump donates US$100,000 from salary to alcoholism research | Main | How to do balance sheet reconciliation in 2024 definition & examples »

Manufacturing Accounting: A Guide for Manufacturers FundKite Business Funding

By admin | November 19, 2021

Manufacturing accounting is a group of inventory and production management processes used for monitoring and controlling the costs involved with manufacturing products. Job costing often involves the cumulation of costs involved in procuring materials, labor expenses, materiality principle in accounting and manufacturing overheads. The job costing process is perfect for businesses that custom-make products for their clients. This method is preferred by manufacturing businesses due to the ability of cost accountants to track the exact production costs involved, allowing them to arrive at an accurate price quote. This method is by far the most common method used in manufacturing businesses to accurately estimate their costs.

This accounting method tracks individual items of inventory, which is useful if you can identify each item with, for example, a serial number or RFID tag. This can produce a higher degree of accuracy, but many manufacturers are unlikely to have items that have a unique identification. This is better for high-value items that need differentiation, rather than interchangeable items. Look at where the inefficiencies are in the production process and where the waste is coming from, adjusting the pricing if required. Standard costing is useful if you are making similar products or large quantities of a specific product. As you streamline manufacturing processes to eliminate waste and shorten the time between receiving and orders, you can also streamline your accounting processes and use them to gather relevant operating information.

- In manufacturing accounting, various financial aspects are addressed, including the cost of raw materials, labor, overhead expenses, and inventory valuation.

- The job costing process is perfect for businesses that custom-make products for their clients.

- You or an accountant should still perform reconciliations to confirm the accuracy of your financial records, but it’s much easier than doing everything by hand.

- To gain a deeper understanding of manufacturing costs and make informed decisions, the software should incorporate data analytics capabilities.

- He’s visited over 50 countries, lived aboard a circus ship, and once completed a Sudoku in under 3 minutes (allegedly).

- When she’s not writing blogs, articles, short fiction, or (kind of bad) French poetry, Kat can be found lacing up her tennis shoes for a run or walk with her pup or scouting for the best karaoke spot in Austin, Texas.

Fixed costs

He now writes articles on personal and corporate finance, accounting and tax matters, and entrepreneurship. Work-in-process (WIP) or work-in-progress inventory refers to products that have made it through part of the manufacturing process but remain unfinished. Though they’re not ready for sale, these goods are still an asset on your balance sheet. The last-in-first-out (LIFO) inventory valuation method is the opposite of the FIFO approach. As a result, your manufacturing company may get to choose between using cash or accrual accounting. While the cash method is often easier to implement, it’s not always the best way to organize your financial records.

Which of these is most important for your financial advisor to have?

Sign up for a demo today and unlock the power of streamlined manufacturing operations. A periodic inventory system is a simplified system for calculating the value of an ending inventory. It only updates the ending inventory balance in the general ledger when a physical inventory count is conducted. Since physical inventory counts are time-consuming, few companies do them more than once a quarter or year. In the meantime, the inventory account in the accounting system continues to show the cost of the inventory that was recorded as of the last physical inventory count.

It can take months to get the raw materials you need, particularly if there are supply chain issues. Unlike other retailers who may simply buy their products from wholesalers, you’re producing a new product from start to finish, including assembling the on-premise workflows and processes to create the finished product. Financial accounting is primarily concerned with the creation of core financial statements such as cash flow reports, balance sheets, income reports, and profit statements. These documents are important when the manufacturing business needs to showcase its credibility and financial performance to investors or funding partners when raising capital. This form of accounting is also useful when the company undergoes regulatory checks and inspections. Financial accounting how much does bookkeeping cost allows businesses to assess overall monetary health and manage finances in the business, making it a crucial aspect of manufacturing bookkeeping processes.

Improved Financial Planning

Unlike job costing, activity costing relies on identifying all the activities in a manufacturing business and proportionately assigns the cost of activities to products based on their activity consumption. Activity-based costing or ABC costing can provide a unique picture when utilized to reveal products that generate profits vis a vis those that don’t. The business can then identify activities or production strategies that might require a revamp to ensure the profit margins are extended. While more specific and accurate, activity-based costing might cause businesses to undertake an unnecessary effort in case the products they produce are simplistic, with their costs being more straightforward to track. Given social security benefits that manufacturing also comes under numerous regulations and tax norms, tax accountants and the process of accounting taxes are crucial to a manufacturing firm.

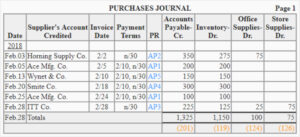

A Manufacturing account can help businesses become more efficient by tracking production costs and inventory levels. This manufacturing account is the final stage of a company’s production process. The direct labor Manufacturing account tracks all of the wages paid to workers directly involved in the production process.

Features found in accounting software such as inventory management can help you optimize the way you use inventory, such as providing alerts when your stock needs replenishing. It is crucial when understanding raw materials, work-in-process, and finished goods. It will avoid a situation where you have too much inventory (which costs money) or, even worse, not enough inventory, where you cannot fulfill the requirements of your customers. This article explains what manufacturing accounting is, the types of manufacturing costs that must be accounted for, and how to accurately value production costs using different methods and technologies. A manufacturing account tracks a manufacturing business’s production costs, materials used, and inventory levels.

In addition to per-part inventory costing, it is also important to track the total number of on-hand inventory units. The two common types that inventory can be arranged in light of this are the perpetual and the periodic inventory system. By applying inventorial techniques to these costs, businesses can identify areas where spending can be reduced, efficiency can be improved, and profitability can be increased. Direct labor is the value given to the labor that produces your goods, such as machine or assembly line operators.

Topics: Bookkeeping | Comments Off

Comments are closed.